FI/RE Chapter 6 - It All Adds Up!

In this post, we’ll explore how to determine if we can actually retire based on our current expenses, savings, and net worth. Additionally, we’ll discuss potential strategies to expedite this.

Story So Far

Sameer would need a corpus of $4M to $5M to become financial independent.

Sameer’s total annual compensation is $350,000, which includes a base salary of $200,000 and RSUs of $150,000.

Over the last 8 years Sameer has accumulated net-worth of $1,000,000.

Sameer maximizes his 401(k) and Health Savings Account contributions from his pre-tax income, thereby reducing his overall taxable income.

Sameer saves $8,500 per month after taxes. He prioritizes investing $3,292 per month by using Mega Backdoor Roth and the remaining $5,290 per month into an index fund.

Sameer’s annual expenses total $120,000, equating to $10,000 per month.

Across both tax-advantage and taxable accounts Sameer saves $137,230 annually.

Post retirement Sameer would require additional $25,000 per year for health insurance and one time expense for $200,000 for his kids college.

Portfolio Growth

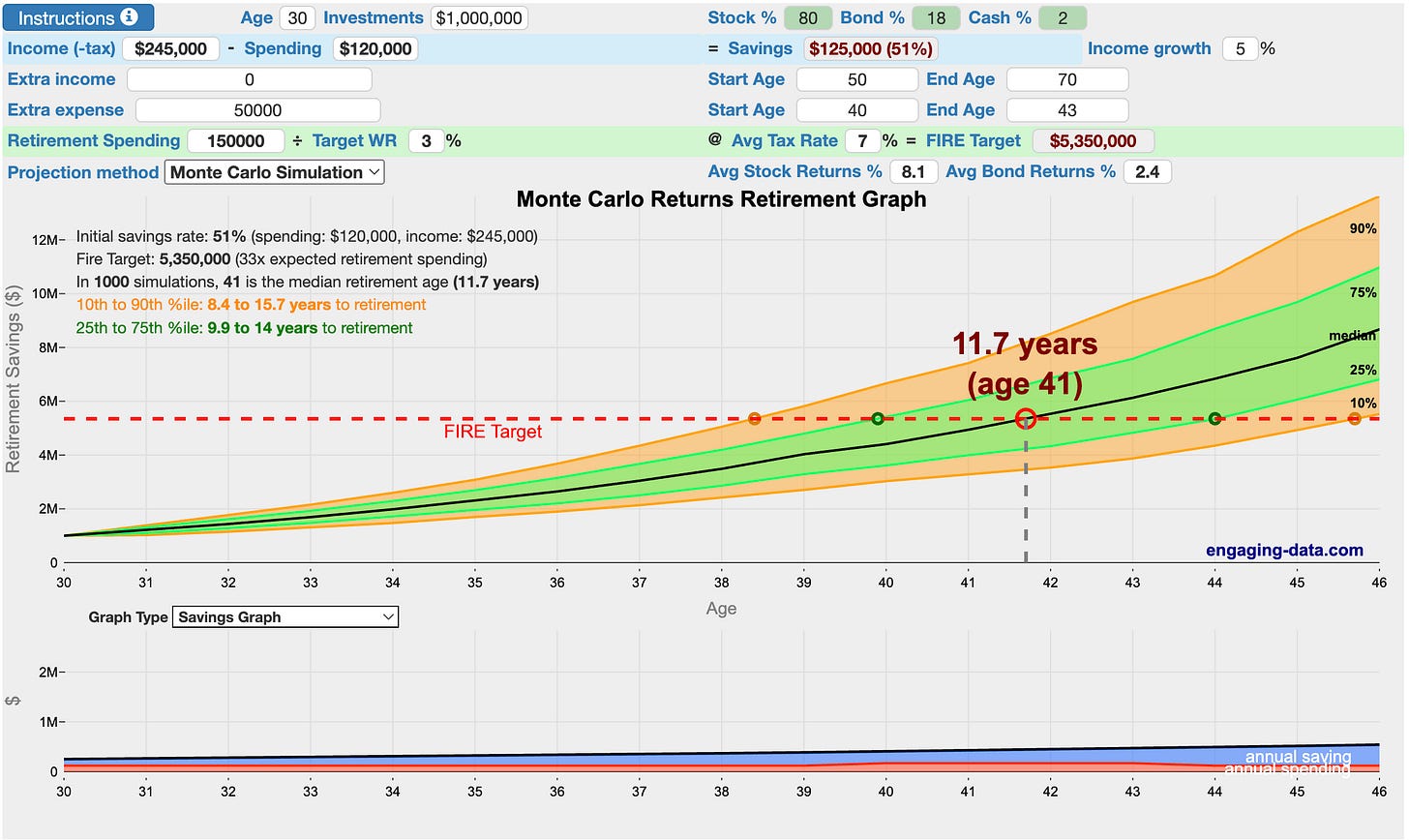

We will now evaluate how much time Sameer would need to build a corpus corpus of $4M to $5M. We will assume Sameer continues in his current role and salary increase at 5% annually. We will also increase the expenses from $120,000 to $145,000 to account for health insurance. We use this tool that helps us calculate the age where Sameer will be able to build a corpus 33x his annual expense. It is a pre-retirement calculator that is useful before you retire to get a sense of how many years it is likely to take to accumulate enough money to retire. It will simulates thousands of possible sets of paths to meet your target and calculates the probability of different trajectories for your retirement investments. As we see from the image below, in order to build a 33x corpus Sameer would need to work for additional 12 years.

Reaching the FI/RE Goal Faster

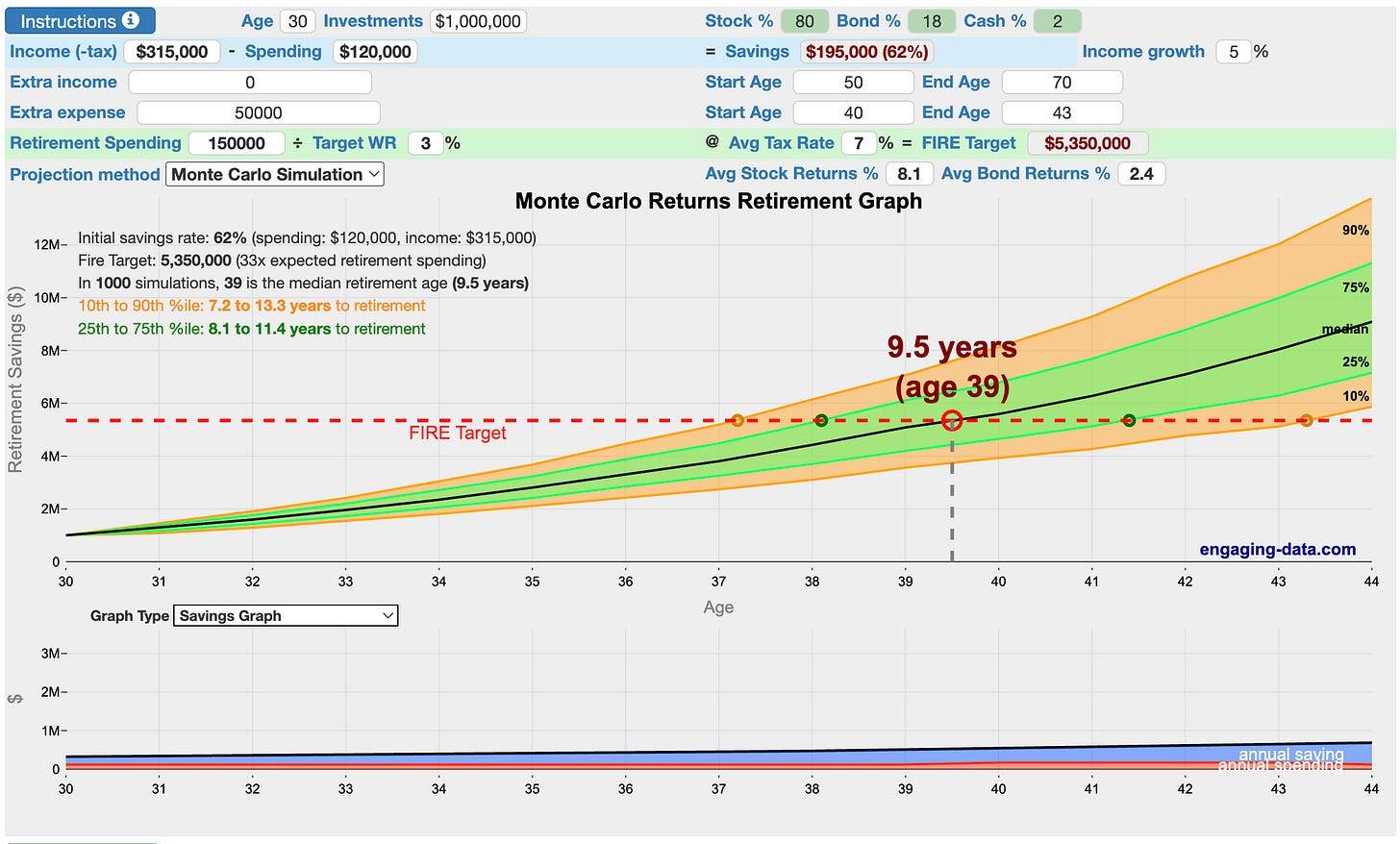

The only way to reduce number of years to retire is to save more money. One way to increase our overall savings is to build other income sources. Since Sameer is already quite good at saving, the only realistic option would be for the spouse to also take up a job, allowing both of them to potentially earn. Let’s assume his spouse takes up a job or is able to generate income through a business to the extent of $100,000. This would increase their total annual salary to $450,000. Assuming a 30% tax rate, we would have an additional $70,000 being saved each month. Let’s see where this leads us.

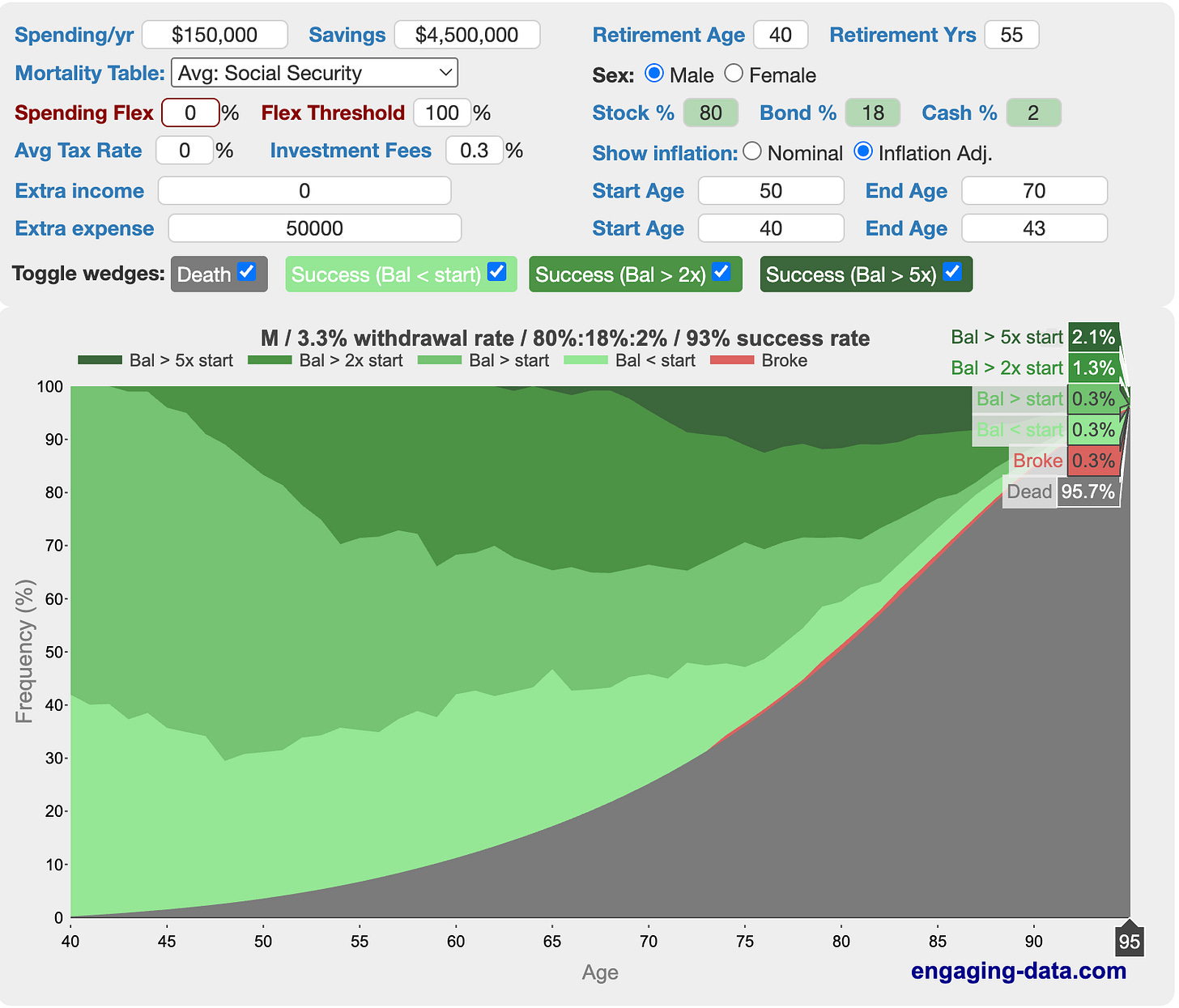

Hey, guess what? Sameer and his family are on their way to financial independence in the next 9 years (instead of 12)! This means that by building additional income streams, they can boost their earnings and even retire early. And here’s the cherry on top: we also ran the numbers and found that their retirement corpus of $4.5 million is expected to last for a whopping 55 years! Isn’t that amazing?

Check out this awesome statistic! With Sameer retiring, there’s a whopping 99.7% chance that this balance won’t run out for the next 55 years. That’s a 0.3% chance of going broke, which is pretty darn low!

Key Takeaways

Financial Goal: Sameer aims to achieve financial independence with a corpus of $4M to $5M.

Current Financial Situation: Sameer has a total annual compensation of $350,000, a net worth of $1,000,000, and saves $8,500 per month after taxes.

Post-Retirement Additional Expenses: Sameer anticipates an additional $25,000 annually for health insurance and a one-time expense of $200,000 for his children’s college.

Retirement Corpus Goal: Sameer aims to build a corpus of $5 million (33 times his annual expenses for retirement).

Estimated Time to Retirement: With Sameer’s current salary and expense projections, it would take 12 years to reach the retirement corpus goal.

Impact of Additional Income: If Sameer’s spouse generates an additional $100,000 annually, they could achieve financial independence in 9 years and have a retirement corpus lasting 55 years.

Note

These calculations doesn’t include Social Security. I’m pretty sure it’ll still be around when I reach full retirement age. It doesn’t include Medicare, which should help lower healthcare costs once we turn 65. Hence the above numbers can be considered conservative.

Investment Disclaimer: The information presented here is for educational purposes only and does not constitute financial, investment, tax, or professional advice. Investments come with inherent risks and are not guaranteed; errors in data may occur. Past performance, including backtest results, does not guarantee future results. Please be aware that indexes serve as benchmarks and are not directly investable. All examples presented are purely hypothetical. Conduct your own thorough research and seek professional advice before making any investment decisions.