FI/RE Chapter 5 - Optimizing Taxable Investments

Hey, what’s Mega Backdoor Roth? Which Index Funds should I pick? In this post, we’ll dive into all the investment options for a taxable account.

Having explored tax-advantaged investment options in previous posts, this post delves into the practical application of taxable investment options in conjunction with after-tax funds.

Story So Far

Sameer’s total annual compensation is $350,000, which includes a base salary of $200,000 and RSUs of $150,000.

Sameer’s annual expenses total $120,000, equating to $10,000 per month.

Sameer maximizes his 401(k) and Health Savings Account contributions from his pre-tax income, thereby reducing his overall taxable income.

Monthly After Tax Savings

Let us analyze Sameer’s take-home pay after incurring monthly expenses of $10,000. For the sake of simplicity, I have distributed $150,000 RSU evenly over the course of 12 months.

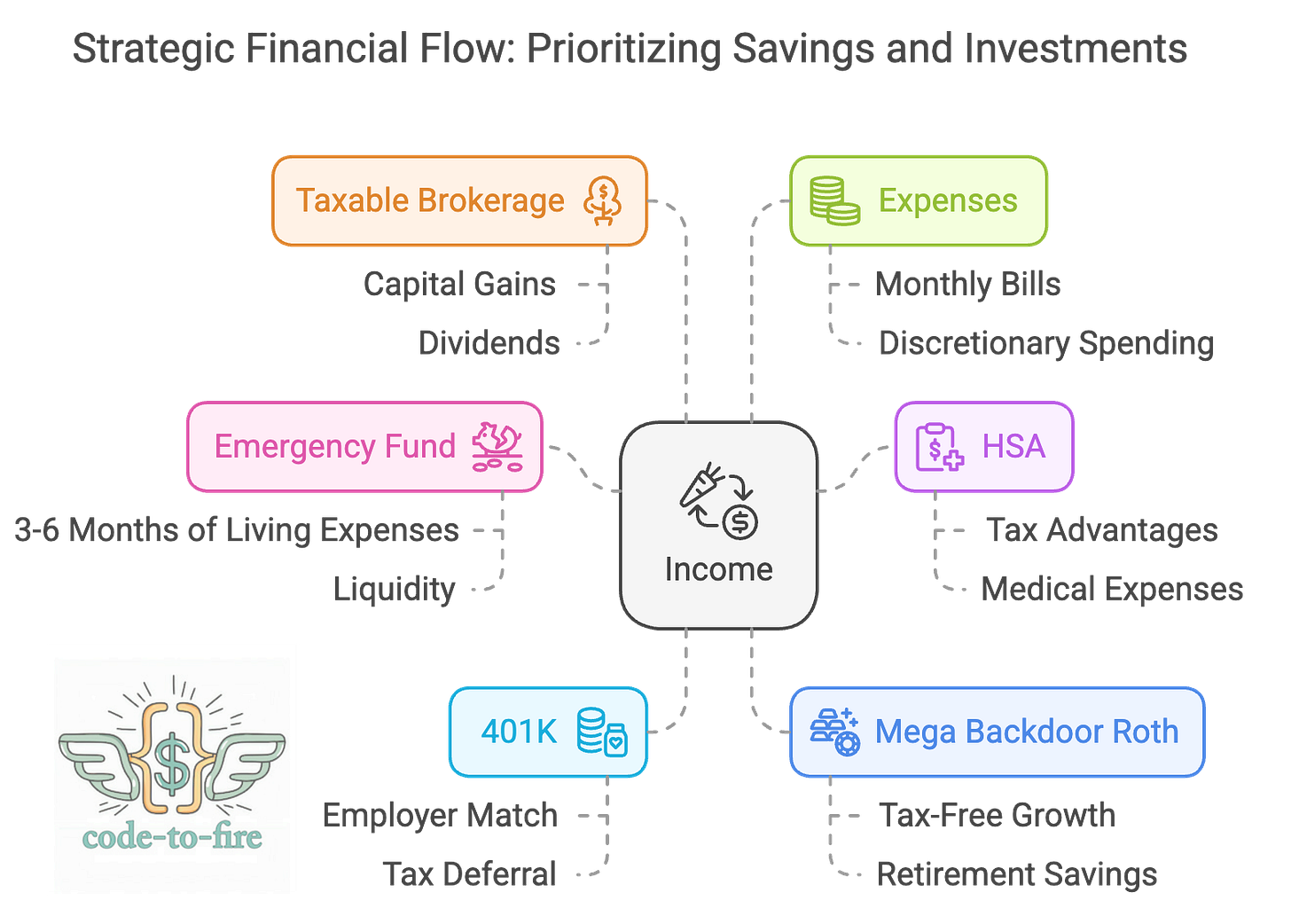

Sameer saves $8,500 per month after taxes. Now we will look into where can Sameer invest this money.

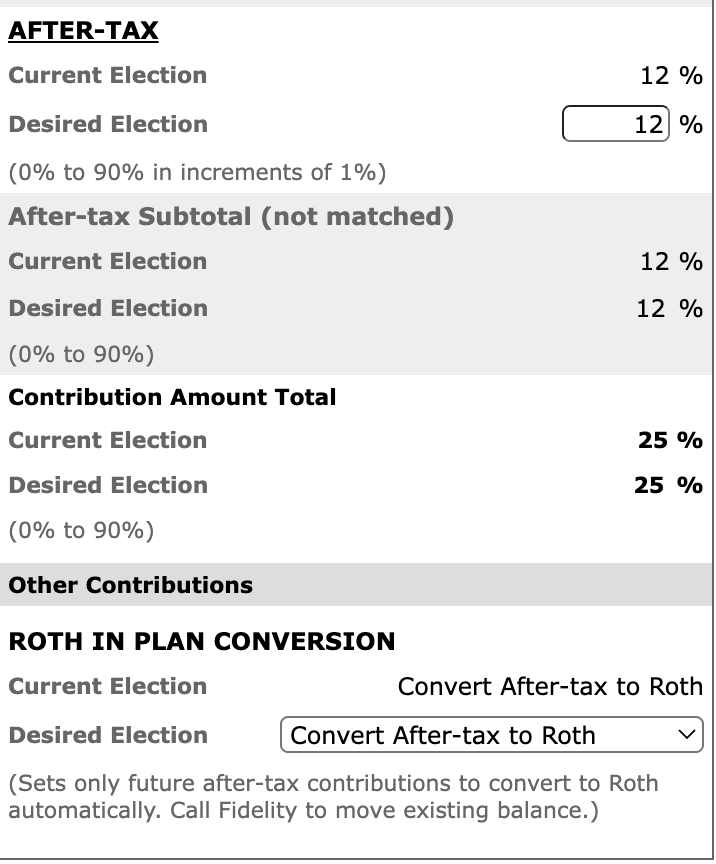

Mega Backdoor Roth IRA

The Mega Backdoor Roth IRA option offered by Amazon is a way for employees to save even more money for retirement in a smart, tax-efficient way. Amazon’s 401(k) plan1 has a special feature that allows employees to contribute more money into their retirement account after reaching the regular 401(k) contribution limit. This extra money is called after-tax contributions (not the same as Roth contributions). You can then move this extra money into a Roth IRA or Roth 401(k), where it can grow tax-free forever. Unlike a regular Roth IRA, there’s no income cap for using the Mega Backdoor Roth.

How Sameer Leverages Mega Backdoor Roth at Amazon

As an Amazon employee, Sameer contributes $22,500 per year (in 2024) to your 401(k) as pre-tax.

Amazon matches 50% of your contributions up to 4% of your salary which is $4,000).

Together, your contributions and Amazon's match add up to $26,500—but there’s a total limit of $66,000 (2024) that includes all contributions to the 401(k). This means you can contribute the difference ($39,500) as after-tax money.

He contributes $39,500 in after-tax money to his 401(k) which equals $3,292 per month.

He then converts the $3,292 per month into Roth 401(k). and this money grows tax-free forever and he won’t pay taxes when he withdraws it in retirement.

Sameer still has $5,290 per month after contributing to Mega Backdoor Roth. Once you’ve maximized your 401(k), HSA, and Mega Backdoor Roth contributions, the next step is to invest surplus money in taxable accounts strategically.

Taxable Accounts

To open a taxable brokerage account, select a prominent brokerage firm such as Fidelity, Vanguard, or Charles Schwab. For individuals who intend to relocate outside the USA for retirement, it’s crucial to evaluate whether the brokerage firm permits account operations beyond the USA. For instance Charles Schwab2 allows individuals residing in India to continue managing their accounts when they leave USA, while Fidelity3, Vanguard only allow limited activity. However, it’s essential to confirm this aspect when choosing your brokerage firm.

Index Funds and ETFs (Exchange-Traded Funds) are two types of investment funds that allow you to invest in a broad group of stocks or bonds, rather than just a single company. Example: If you invest in the Vanguard S&P 500 Index Fund (VFIAX), you are buying a small piece of all 500 companies in the S&P 500.

Below are some of the commonly used Index Funds. You can choose to pick any one based on your requirements.

Recommendation

Simplify with VTWAX: If you prefer one fund for stocks, Vanguard Total World Stock Index Fund (VTWAX) is ideal.

DIY Split with Fidelity/Schwab: For cost-conscious investors, combine Total Market and International funds from Fidelity or Schwab to replicate global diversification.

Actions Sameer Takes for Taxable Accounts

Given Sameer is just 30 years old he can choose aggressive portfolio which focuses on stocks, especially large U.S. companies in the S&P 500. Sameer invests the $5,000 into VFIAX or FXAIX per month.

Lets Recap

Sameer saves $8,500 per month after taxes. He prioritizes investing $3,292 per month by using Mega Backdoor Roth.

Sameer invests the remaining $5,000 per month into VFIAX or FXAIX Index Fund in any brokerage account (Fidelity/Vanguard/Charles Schwab).

Investment Disclaimer: The information presented here is for educational purposes only and does not constitute financial, investment, tax, or professional advice. Investments come with inherent risks and are not guaranteed; errors in data may occur. Past performance, including backtest results, does not guarantee future results. Please be aware that indexes serve as benchmarks and are not directly investable. All examples presented are purely hypothetical. Conduct your own thorough research and seek professional advice before making any investment decisions.

Not All Companies Allow This: Amazon’s 401(k) plan specifically permits after-tax contributions and in-plan Roth conversions, which are essential for the Mega Backdoor Roth strategy.

Both Fidelity and Vanguard Account holders moving to eligible countries outside USA may maintain their existing accounts, but will not be able to establish new accounts. Unsolicited trades for most stocks and Exchange Traded Funds (ETFs) will continue to be allowed, but purchases of new mutual funds or adding to existing funds will be unavailable, although automatic dividend reinvestment can continue.

Finally found a good source for backdoor Roth IRA, thanks for simplifying this.