FI/RE Chapter 4 - Optimizing Tax Advantage Investments

In this post we discuss what all steps we should take to saves taxes while at the same time building an investment portfolio.

How do we go about finding out if Sameer can accumulate $4M - $5M in the next 10 years? Achieving financial independence (FI) involves careful planning, disciplined saving, and smart investing.

Let’s take a look at the steps Sameer has taken to reach financial independence. If you want to know the nitty-gritty, check out those posts.

Step 1 : Understand Your Financial Independence Goal

Define FI: FI means having enough investments and savings to cover your living expenses indefinitely without relying on employment income.

Calculate Your FI Number: We have established that Sameer needs $4M - $5M to successfully retire in Seattle, WA in next 10 years.

Step 2: Assess Your Current Financial Situation

Track Your Income and Expenses: We analyzed Sameer’s annual expenses and savings over the past eight years using Fidelity Full View.

Sameer’s total annual compensation is $350,000, which includes a base salary of $200,000 and RSUs of $150,000.

Calculate Net Worth: Sameer’s net worth is approximately $1,050,000 ($930,000 + $120,000).

Establish an Emergency Fund: Sameer has 12 months’ worth of expenses ($120,000) in a liquid, low-risk account (High Yield Savings Account).

In this post we will focus on building a strong foundation on prioritizing investments i.e. indicating the appropriate order in which investments go into different accounts. This post will specifically focus on optimizing tax-advantage accounts which include 401(k) and HSA. Here is a general account funding priority that often works well for many people.

Roth IRA

A Roth IRA is a special type of retirement account that lets your money grow tax-free. Here's how it works in simple terms:

You Pay Taxes Now, Not Later: When you contribute to a Roth IRA, it’s from your after-tax income, which means you’ve already paid taxes on that money, such as your paycheck. The significant advantage is that once your money is in the Roth IRA, it grows tax-free. This means you won’t have to pay taxes when you withdraw it during retirement.

Tax-Free Growth for the Long Haul: Any interest, dividends, or gains your investments generate within the account won’t be subject to taxes when you withdraw them in the future.

Flexibility: You have the freedom to withdraw the money you contributed (but not the earnings) anytime without incurring penalties or taxes. It serves as a safety net.

Actions Sameer Should Take

In 2024, you can contribute the full amount if your modified adjusted gross income (MAGI) is below $153,000 (single) or $228,000 (married filing jointly). Partial contributions are allowed if you're over these limits but below $163,000 (single) or $243,000 (married filing jointly). Given Sameer MAGI is $350,000 he cannot contribute to Roth IRA.

401(k)

Amazon and other FAANG employers provide the option to contribute to a Traditional 401k and an after-tax Roth 401k with automatic rollover, commonly referred to as the “mega back-door roth.” We’ll delve into the “mega back-door roth” in the subsequent post, as it involves a taxable investment. For now, let’s concentrate on the Traditional 401(k). You have the flexibility to choose the percentage of your salary you wish to invest, and these contributions will be automatically deducted from your paycheck.

Tax Benefits

Contributions are made before taxes, thereby reducing your taxable income in the present. For instance, if Sameer’s base salary is $200,000 and you contribute $22500 (the 2024 contribution limit), you’ll only be subject to taxation on $177,500. Investments in your 401(k) grow tax-free until withdrawal during retirement.

Employer Matching (Free Money!)

Many employers, such as Amazon, provide a 401(k) match. Amazon’s match is 50% of the first 4% of the salary you contribute. For instance, if Sameer earns $200,000 and contributes $8,000 (4% of your salary), Amazon will contribute an additional $4,000.

By default Amazon will set your investments for all your contributions to a good low-fee Vanguard Target Date retirement funds which are all-in-one investment options designed to simplify retirement investing. They are a type of mutual fund that automatically adjusts their asset allocation (mix of stocks and bonds) over time, based on your target retirement year. These are a perfect example of Set-It-and-Forget-It portfolio which is ideal for investors who want a hands-off approach. There is no need to rebalance your portfolio—Vanguard will do it for you.

Actions Sameer Should Take

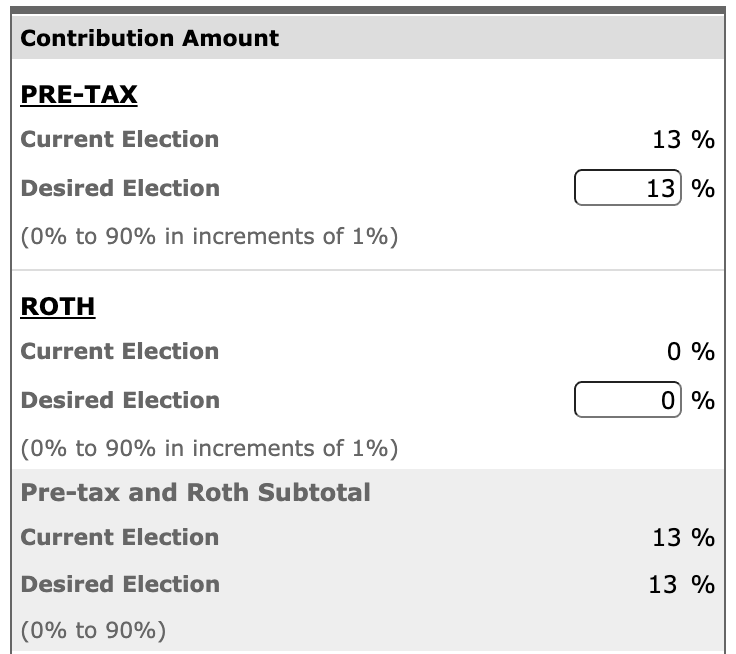

In order to maximize 401(k), Sameer will invest 11.5 % of his paycheck monthly which will help him maximize both 401(k) limit ($24,000) and Amazon’s contribution ($4,000). This 11.5% comes from the simple math of (Max Contribution Allowed)/(Base Salary).

HSA

An HSA (Health Savings Account) is a triple tax-advantaged savings tool that allows you to contribute up to $3,850 annually, reducing your taxable income. The money grows tax-free and can be used for qualified medical expenses without tax penalties. Contributions, growth, and withdrawals for medical expenses all benefit from triple tax advantages. Once your HSA balance reaches a certain amount (usually around $1,000 or more), you can invest the funds in a variety of investment options, such as mutual funds or stocks, just like in a 401(k). This means your HSA can grow faster over time, especially if you’re not using it for medical expenses right away.

Actions Sameer Should Take

In order to maximize HSA, Sameer will invest $321 ($3850/12) of his monthly paycheck monthly which will help him maximize HSA value and reduce his taxable income.

Monthly Salary Breakdown

Now that Sameer has taken advantage of Tax-Advantaged Accounts, let’s compare two scenarios. We’ll assume Sameer is a married individual filing taxes jointly.

Scenario 1: Annual Savings with Contributing to 401(k) & HSA

Scenario 2: Annual Savings with Not Contributing to 401(k) or HSA

Scenario 1: Contributing to 401(k) and HSA (With Employer Match)

Annual Take-Home Pay (With 401(k) and HSA):

Annual Take-Home: $10,423.46 × 12 = $125,081.52

Estimated federal income tax for $169,750 taxable income: $26,708.50.

Pre-Tax Contribution: $34,250

With 401(k) and HSA Contributions): $26,500 ($22,500 from Employee Contribution + $4,000 from Employer Match)

HSA Contribution: $7,750

Scenario 2 : Not Contributing to 401(k) or HSA

Annual Take-Home Pay (No 401(k) or HSA):

Annual Take-Home: $12,569.87 × 12 = $150,838.44

Estimated federal tax: $31,429.50.

Final Thoughts

We observe that while the take home salary increase from $125,081.52 to $150,838.44 ($25,757) in Scenario 2, the total amount available for investment is 37% higher in Scenario 1 ($34,250 as compared to $25,000) as Sameer was not only able to invest an additional $9250 but also reduced his taxes by $4721 . Also if we assume a modest 6% annual return on 401(k) and HSA contributions, compounded annually we see that their total savings is is about ~$10,500 more (42% higher) in Scenario 1.

Lets Recap

In this post we identified how to go about maximizing your tax-advantaged accounts like 401(k) and HSA.

Amazon offers the option to maximize 401(k) and HSA contributions through Fidelity via the NetBenefits App. This setup also automates our tax-advantaged accounts.

The employer's 401(k) match and tax benefits from contributing to the 401(k) and HSA help boost the total savings, despite the lower take-home pay due to the contributions.

We observed that if the person contributes to 401(k) and HSA, their total savings are higher than if they didn’t contribute to these accounts. The investment growth in 401K and HSA can further enhances the savings from the initial contributions.

In the next post, we will look at how to invest and diversify our taxable investments (post-tax money) to build our final leg of portfolio towards financial independence.

Investment Disclaimer: The information presented here is for educational purposes only and does not constitute financial, investment, tax, or professional advice. Investments come with inherent risks and are not guaranteed; errors in data may occur. Past performance, including backtest results, does not guarantee future results. Please be aware that indexes serve as benchmarks and are not directly investable. All examples presented are purely hypothetical. Conduct your own thorough research and seek professional advice before making any investment decisions.