FI/RE Chapter 3 - Finding Your Net-worth

What is my net-worth? How do I automate tracking my expenses and savings?

In the last post we arrived at the FI/RE number for Sameer. We also established tracking mechanism for expenses, savings and net-worth.

FI/RE Goal: Sameer would need a corpus of $4M to $5M to become financial independent.

In this post, we’ll explore Sameer’s net worth, which will serve as a starting point for our current savings.

How much do I have right now?

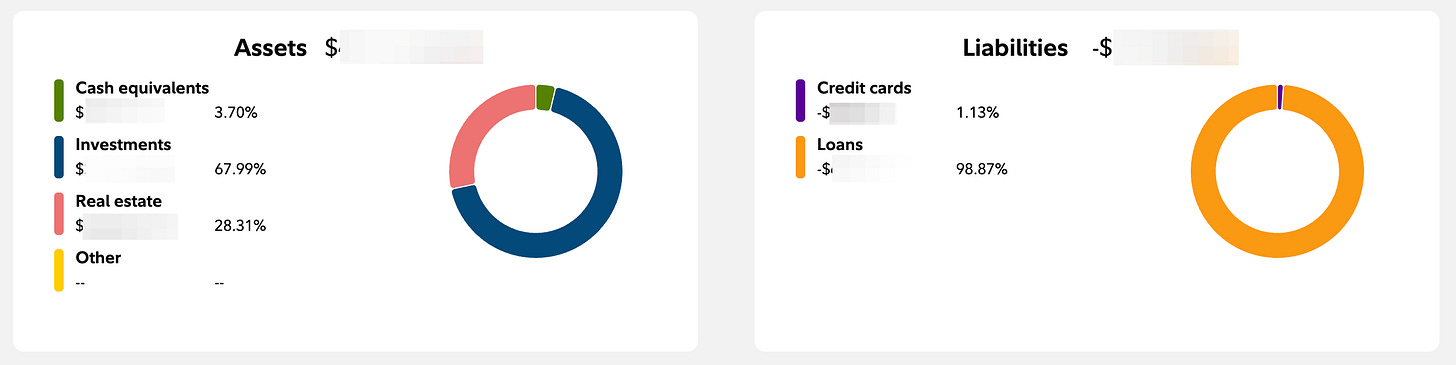

This essentially involves calculating the total net worth of your investments, which encompasses stocks, index funds, bonds, and cash. However, I would exclude the value of your primary residence from this calculation. If you’re using any of the aforementioned apps, this process would be relatively straightforward, as they can also categorize your source of income and investment allocation. Below is a screenshot of information that Fidelity Full View provides.

Before delving into Sameer’s savings, let’s grasp some fundamental concepts about various asset classes. This knowledge is crucial in determining the allocation of your portfolio to different asset classes and in managing the overall risk and return of your portfolio.

Stocks, which represent ownership shares in publicly traded companies, provide the potential for substantial long-term capital appreciation and dividend income. However, they are also known for their higher volatility and growth potential.

Bonds, issued by governments, municipalities, and corporations, are debt securities that offer fixed interest payments over a predetermined period, accompanied by the return of the principal amount at maturity. Compared to stocks, bonds are generally considered less risky and provide more stable income.

Real estate investments encompass residential properties, commercial properties, and real estate investment trusts (REITs). These investments provide potential income through rental payments and the possibility of capital appreciation.

During his first three years prior to joining Amazon, he diligently used his savings to pay off student debt, which ultimately helped him complete his B.E. in Computer Science. Its safe to assume debt of $200,000 as the cost of B.E. in Computer Science in USA. Let’s analyze Sameer’s career trajectory, given he began as an SDE-1, 8 years ago at Amazon. During years 5 and 6, he got married and had a kid. I’ve sourced his starting compensation for entry-level positions from levels.fyi, a reputable industry resource. Over the course of 8 years, we’ll track his salary growth and annual expenses. Finally, we’ll calculate the total savings he accumulated during this period.

If we checkout out Sameer’s impressive salary history over the past eight years we observe the total compensation has doubled, and he’s been promoted twice. His latest compensation package, worth $350,000, includes a base salary of $200,000 and RSUs valued at $150,000. This is quite typical for employees at FAANG companies.

In the two tables below, we analyze the annual expenses for eight years.

It’s evident that the annual expenses nearly doubled once Sameer got married. During his single years, he managed to save 40% to 50% of his salary, whereas in later years, his savings dropped to 25% to 35%. Lets see how much Sameer has saved over the last 8 years.

Summary of Financial Milestones

Years 1–4 (Single): Aggressive savings (~40–50% savings rate) due to lower expenses.

Years 5–8 (Married with Child): Savings rate decreases to ~20–35%, but total savings grow due to higher income.

Cumulative Savings After 8 Years: ~$823,000.

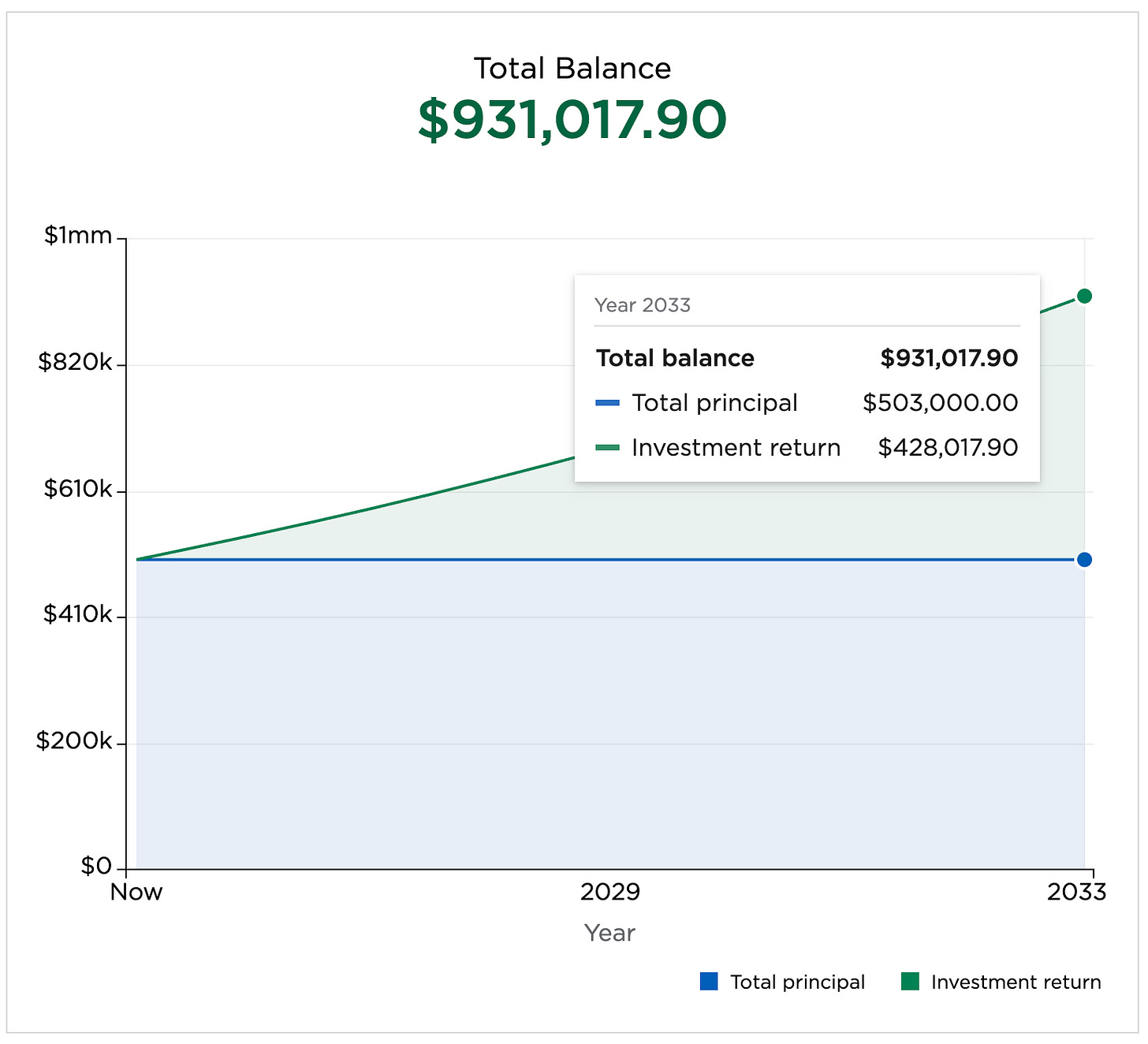

Based on the data above, Sameer saved ~$100,000 annually on average over the last 8 years which totals to ~$823,800. Setting aside 12 months of savings in emergency fund which is roughly ~$120,000 and removing $200,000 debt, Sameer invested the remaining $503,000 in an index fund. Assuming Sameer invested this money in balanced portfolio (60% Stocks / 40% Bonds) it would fetch him 8% returns (based on historic data). $503,000 invested over the last 8 years would now be ~$931,000. Don’t worry, we will look at different options to invest in the next post. For now just assume it was invested in a diversified index fund which fetched him 8% returns.

Including the emergency fund his net-worth becomes $~1,050,000 ($930,00 + $120,000).

Lets Recap

We have established that Sameer needs $4M - $5M to successfully retire in next 10 years.

Sameer has $120,000 invested in an emergency fund which is HYSA (High Yield Savings Account).

Sameer had a whopping $100,000 savings every year for the past 8 years! That’s a lot of money! After paying off his education loans, he managed to build a pretty impressive corpus of around $931,000 by investing $503,000 in an index fund (at an 8% yield). That’s some serious financial success!

Sameer’s net-worth stands at $1,050,000 ($930,00 + $120,000)

In our next post, we’ll delve into the actions Sameer should take to maximize savings, identify investment streams and minimize taxes, thereby building a efficient portfolio. We’ll also assess the timeframe within which this target is achievable and take proactive steps to reach our ultimate FIRE goal. Make sure to subscribe to be the first to know when the next phase is published.

Investment Disclaimer: The information presented here is for educational purposes only and does not constitute financial, investment, tax, or professional advice. Investments come with inherent risks and are not guaranteed; errors in data may occur. Past performance, including backtest results, does not guarantee future results. Please be aware that indexes serve as benchmarks and are not directly investable. All examples presented are purely hypothetical. Conduct your own thorough research and seek professional advice before making any investment decisions.