FI/RE Chapter 2 - Define The Goal

As a FAANG software engineer, what is the FIRE number I should aim for? How do I come up with this number? We answer these questions by using a real world example in this post.

Welcome to another post. In the last post we understood what financial independence means and briefly went over different types and the amount of savings you need to achieve FI/RE. In this chapter we will focus on real world example of defining the problem and identifying how much we need to successfully retire.

Real Life Example

Phase 1 - Understand The Problem

Sameer, a 30-year-old Sr. Engineer at Amazon, earns an annual compensation between $300,000 and $400,000. He began his career as a Software Engineer (SDE-1) at Amazon 8 years ago. Currently, he lives in a house and resides with his wife and their kid. His goal is to retire by the age of 40 in a city with a high cost of living, such as Seattle (or its suburbs like Bellevue, Bothell, Issaquah, Snoqualmie, and Maple Valley).

Stated Goal: Save enough money to be financially independent by the age of 40 (10 years away from retirement).

Personally my FI/RE mission is to achieve financial independence and the ability to retire early so that I can pursue my passions without financial constraints. I envision a life where work becomes an optional choice rather than a mandatory one, allowing me to have more time for my family, personal growth, and experiences.

Phase 2 - Identify Key Areas (KPIs)

In this phase, we break down our overall goal into smaller, achievable objectives. Additionally, we pinpoint key investment areas (or Key Performance Indicators) that can assist us in reaching these goals. Now, if we consider the logical approach, the only viable ways to enhance your net worth are to.

Minimize your expenditures.

Increase your savings.

Increase your investments.

Identify new income streams.

Before we can take any action, we need to establish a baseline for each of the above areas.

Expenses: How much do I spend annually?

Savings: How much am I saving annually?

Portfolio: What is my current portfolio of investments?

Passive Income: How much of my income is coming from dividends and interest?

Before we delve into these we need to get an answer to “How much is enough to retire?”

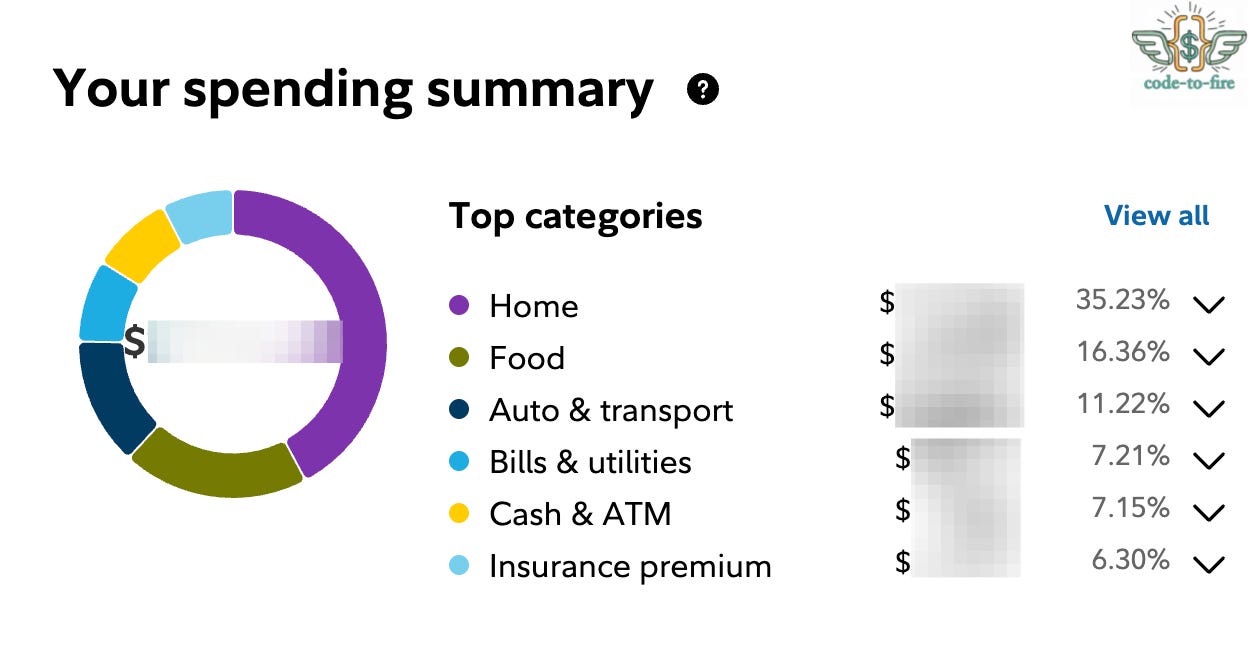

Essentially, we require some kind of instrumentation to monitor the above four key metrics. When I began tracking my expenses in 2016, there was only one app called Mint (which has since ceased operations). Fortunately, in today’s world, there are numerous excellent free and paid tools available that can help establish a baseline for you. Below are some options, and you can choose any one of them based on your requirements. Personally, I use Quicken Simplify and Fidelity Full View because my employer uses Fidelity to manage my 401K, HSA, and RSUs. I like Quickens user-friendly interface and probably has the cheapest subscription of all. Fidelity has excellent customer service and is free, but I sincerely hope they integrate this feature into the mobile app so that I don’t have to switch back to the web or desktop.

Continuing our example, here’s the view of annual expenses you can expect with Fidelity Full View. In 2024, Sameer had an annual expense of $120,000, which included mortgage, utilities, groceries, daycare travel, and insurance. To get a more accurate picture, I suggest averaging out expenses for FY22, FY23, and FY24 to exclude any one-off expenses that could skew this number. Now that we have our annual expenses tracked, we can easily identify our FI/RE goals.

Factoring in Healthcare and College Costs

As we observed in the previous post, we must factor in $1,000,000 for healthcare insurance and college expenses for one child. This amount is crucial to sustainably cover these expenses using the safe withdrawal method.

Lets Recap

How much does Sameer need to afford the same standard of living after retirement?

Using Fidelity Full View, we identified Sameer’s annual expenses to be $120,000.

Using the 3% Rule, Sameer would require a substantial corpus of $4,000,000 (calculated as $120,000 multiplied by 33).

Conversely, the 4% Rule suggests a more conservative corpus of $3,000,000 (derived from $120,000 multiplied by 25).

However, when we factor in the cost of healthcare and college tuition, which amounts to $1,000,000, these figures increase the corpus target to approximately $4 million to $5 million (rounded to the nearest million).

If Sameer aims to retire early while preserving their current lifestyle and maintaining the same spending habits, they’ll find themselves somewhere between these two figures.

This becomes the Financial Independence/Retire Early (FI/RE) goal for Sameer, which spans from $4 million to $5 million.

Where did 25x and 33x come from? I have covered in detail on why early retirees should target 33x in this post below.

Now that we’ve defined our goal range, we can finally move on to identifying opportunities to reach it. Don’t miss out on the next phase; subscribe to be notified as soon as it’s published.

Investment Disclaimer: The information presented here is for educational purposes only and does not constitute financial, investment, tax, or professional advice. Investments come with inherent risks and are not guaranteed; errors in data may occur. Past performance, including backtest results, does not guarantee future results. Please be aware that indexes serve as benchmarks and are not directly investable. All examples presented are purely hypothetical. Conduct your own thorough research and seek professional advice before making any investment decisions.