Beyond RSUs: Smart Strategies for a Diversified Portfolio

Diversification is key to protecting your financial future. Here are some strategies to reduce reliance on your company stock while maintaining a strong investment portfolio.

If you work at a FAANG+ company, chances are a significant portion of your compensation comes in the form of company stock—whether through RSUs, ESPPs, or stock options. While this can be a great way to build wealth, being too concentrated in one stock carries risks. By following this structured plan, you can reduce risk, optimize growth, and ensure financial independence beyond single stock. 🚀

Single Stock Concentration

Many folks keep their vested RSUs because they don’t have a plan to get rid of them or think their company is the best. Often this comes to phycological factor where people often hold RSUs due to emotional attachment or overconfidence in their company which can be risky.

Over the past year, major tech companies have reached their highest market values. Below is a table that aids us in comparing the 10-year performance of FAANG MULA stocks against some well-known index funds.

What does the above table tell us? Over the last 10 years, big tech stocks like Netflix (+32%) and Amazon (+29%) grew way more than funds like VGT (tech ETF, +21%) or the S&P 500 (+13%). But these stocks also crashed harder—like losing 50% in bad years (2022)—while ETFs dropped less. The tech ETF (VGT) was a safer middle ground, growing almost as much as top stocks but with smaller swings. Global funds (VT) lagged behind because they include slower-growing non-U.S. companies. The lesson: single stocks can skyrocket but are risky rollercoasters, while ETFs let you ride tech growth without betting everything on one company. If you hate big risks, stick with ETFs or mix them with a few stocks.

Lessons Learnt: Early in my career, I kept my RSUs vested in the same company. This resulted in a situation where over 75% of my entire portfolio was concentrated in a single stock. However, over the past four years, I have consistently sold my RSUs whenever they vest and have actively diversified my existing concentration to minimize the risk. As a result, I am currently at a 35% concentration level and plan to reduce it to 15% by the end of 2025.

How are RSUs taxed?

RSUs are taxed as ordinary income upon vesting, holding them doesn’t offer tax advantages. Unlike stock purchased with cash, RSUs are taxed as income at vesting, meaning:

You already paid income tax (30% for most of HENRY’s) on the stock’s value when it vested.

Any growth after vesting is subject to capital gains tax when you sell:

Short-term capital gains (if sold within 1 year) = taxed at your income tax rate (30%).

How Much RSUs Should You Keep?

Holding too much company stock creates significant concentration risk, especially when your salary and benefits already depend on the same company. The recommended maximum concentration in a single company stock should be between 5-10% of your total investment portfolio.

🔹 Keep no more than 5-10% of your total net worth in a single stock.

🔹 If your vested RSUs exceed this limit, prioritize selling and reallocating into diversified assets.

📌 Example: If your total portfolio is $500K, limit single stock holdings to $25K-$50K max.

When to sell and diversify?

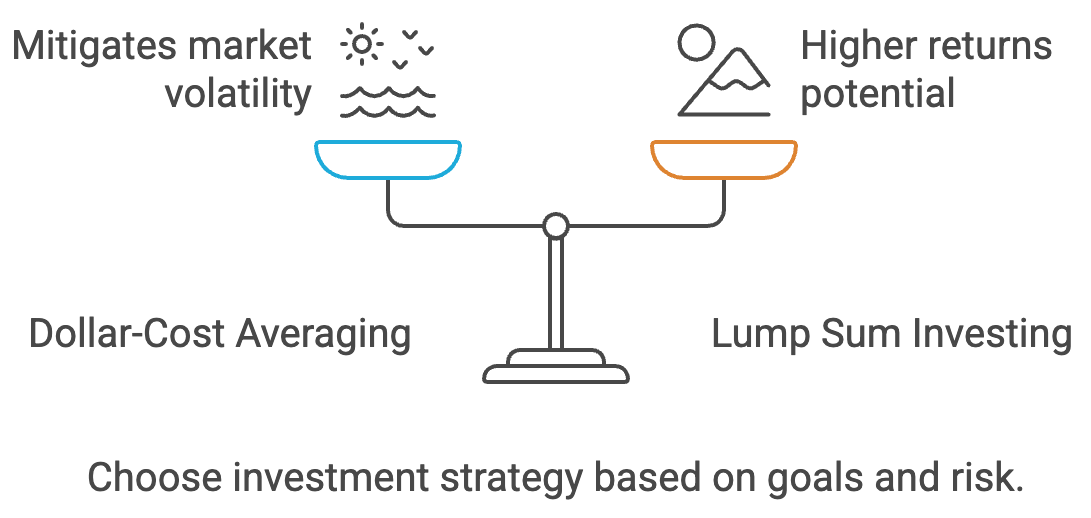

Here’s a structured approach using Dollar-Cost Averaging (DCA) vs. Lump Sum Selling, guidance on optimal company stock concentration, and alternative ETFs for diversification.

Lump Sum Selling

Selling all RSUs immediately upon vesting and reinvesting in a diversified portfolio has historically yielded higher returns. Why?

Time in the Market > Timing the Market: Investing immediately allows your money to compound sooner.

Reduces Single-Stock Risk Quickly: Amazon stock can be volatile. Holding too much exposes you to unnecessary risks.

📌 Best for: Employees who want to fully mitigate stock exposure and reinvest into a diversified portfolio quickly.

Dollar-Cost Averaging (DCA)

DCA involves selling RSUs gradually over time (e.g., over 6-12 months) rather than all at once. Benefits include:

Reduces Short-Term Volatility Risk: Avoids selling all shares at a low point in companies stock cycle.

Psychological Comfort: More manageable for employees hesitant about selling large stock amounts at once.

Smooths Out Market Entry Timing: If reinvesting into ETFs, DCA ensures you don’t buy into market peaks.

📌 Best for: Employees who prefer a gradual approach or believe company stock will appreciate in the short term.

DCA vs. Lump Sum: Which is Better?

Lump Sum > Dollar-Cost Averaging (DCA)

Historical Edge: Lump sum outperforms DCA ~67% of the time, as markets rise 75% of the time.

Exception: Use DCA only if psychological comfort outweighs statistical advantage (e.g., during extreme market uncertainty)

✅ Recommendation: Best of both the words. Follow a hybrid approach:

Sell 50% immediately upon vesting (lump sum) to reduce concentration risk.

Sell the remaining 50% using a DCA strategy (e.g., selling some % per month).

Where to Reinvest?

Choosing Between VGT, VOO, and VT

If you want pure tech exposure, invest in VGT (but it's highly volatile).

If you want broad U.S. market exposure, invest in VOO (covers all sectors, including tech).

If you want global diversification, invest in VT (includes both U.S. and international stocks).

Since VOO already holds ~28% in tech stocks, investing in both VGT and VOO can cause redundancy. To balance exposure:

Recommended Allocation for a Tech-Heavy, Yet Diversified Portfolio:

✅ 50% VOO → Broad U.S. market with a tech tilt (~28% of VOO is tech).

✅ 30% VGT → Extra tech exposure without over concentration.

✅ 20% VXUS → International diversification.

Recommended Allocation for US Heavy Investment Portfolio

✅ 50% VTI → Total US Market Exposure.

✅ 30% VOO → S&P 500 Large-Cap Focus

✅ 20% VXUS → International diversification.

Recommended Allocation for Global Investment Portfolio

✅ 100% VT → broad range of global stocks, investing in both U.S. and international markets (developed and emerging).

RSU Diversification Strategy Example

In this example we’ll use a Hybrid Approach (50% Lump Sum, 50% DCA over 6 months) for diversification. We will continue with our previous example of Sameer who get $150K annually in RSUs which amounts to a $37.5K/Quarter. Here is a plan to diversify.

Note for Amazon Employee: Amazon’s 2025 Cash Option: Starting 2025, eligible employees (L4–L8) can convert 25% of 2025–2026 RSUs to cash at a preset price. This reduces equity exposure upfront while retaining 75% as stock.

Now back to our example.

Implementation Plan for Sameer

Immediate Action for New Vests

Set up automatic sell orders for RSUs upon vesting

Immediately reinvest proceeds into your diversified ETF portfolio

Maintain Amazon position at maximum 10% of total portfolio.

Each Quarter (March, June, September, December)

Sell 50% Immediately ($18,750) → Reduce Amazon stock concentration & reinvests into diversified assets.

Sell 50% Gradually Over 3 Months ($6,250/month) → Reduces short-term price fluctuation risk.

💡 Alternative Option: If you’re comfortable with higher risk, you could sell 100% at vesting and reinvest as a lump sum for historically higher returns.

Existing RSU Holdings

If current Amazon position exceeds 10%, create a systematic reduction plan

Sell portions quarterly until reaching target allocation

Consider tax implications and use tax-loss harvesting when possible

Ongoing Management

Review portfolio allocation quarterly

Rebalance when asset classes drift more than 5% from targets

Adjust strategy during annual compensation reviews when receiving new RSU grants

Final Takeaways

Sell RSUs Strategically – Use a hybrid 50% lump sum / 50% DCA over 6 months approach.

Keep Stock Exposure in Check – Hold no more than 5-10% of net worth in a single stock.

Reinvest Wisely – Allocate RSU proceeds into broad market ETFs, bonds, and alternative investments for long-term diversification.

Annual Reassessment – Reevaluate your RSU stock exposure every time when RSUs vest.

Investment Disclaimer: The information presented here is for educational purposes only and does not constitute financial, investment, tax, or professional advice. Investments come with inherent risks and are not guaranteed; errors in data may occur. Past performance, including backtest results, does not guarantee future results. Please be aware that indexes serve as benchmarks and are not directly investable. All examples presented are purely hypothetical. Conduct your own thorough research and seek professional advice before making any investment decisions.